33+ mortgage as percentage of income

Web Ideally home buyers should put at least 20 percent down on their new dwelling but thats simply not possible for many buyers. Keep your mortgage payment at 28 of your gross monthly income or lower.

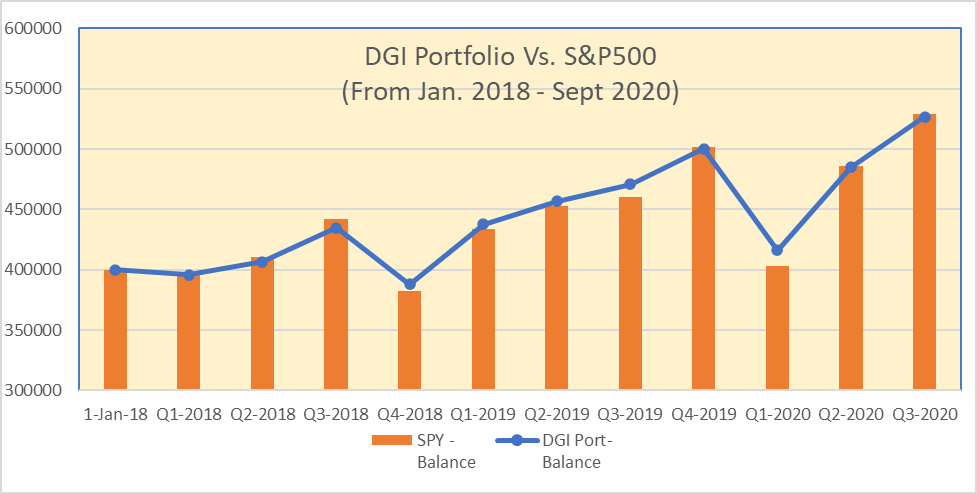

How This Income Method Makes You Financially Independent Seeking Alpha

Web Mortgage-to-income ratio is calculated by dividing your expected mortgage payment by your monthly gross income.

. Web The 3545 Model. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Compare Offers From Our Partners To Find One For You.

Compare Offers From Our Partners To Find One For You. Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross.

A 20 down payment is ideal to lower your monthly. Web The percentage of your taxable income that you pay in taxes is called your effective tax rate. Web The Bottom Line.

This rule says you. Most home loans require a down payment of at least 3. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more.

On a 400000 property a 20. Were not including any expenses in estimating the. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Keep your total monthly debts including your mortgage. Web But there are two other models that can be used. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

The maximum loan amount one can borrow normally correlates. Ad Check How Much Home Loan You Can Afford. Web The amount of money you spend upfront to purchase a home.

191651 to 416700. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Compare Loans Calculate Payments - All Online.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. The 28 rule isnt universal. Then your debt-to-income ratio is 33 percent.

Web The 2836 rule stipulates that in order for a home to be considered within your budget your housing expenses such as mortgage payments taxes and insurance. Total of 360 Mortgage Payments. Some financial experts recommend other percentage models like the 3545 model.

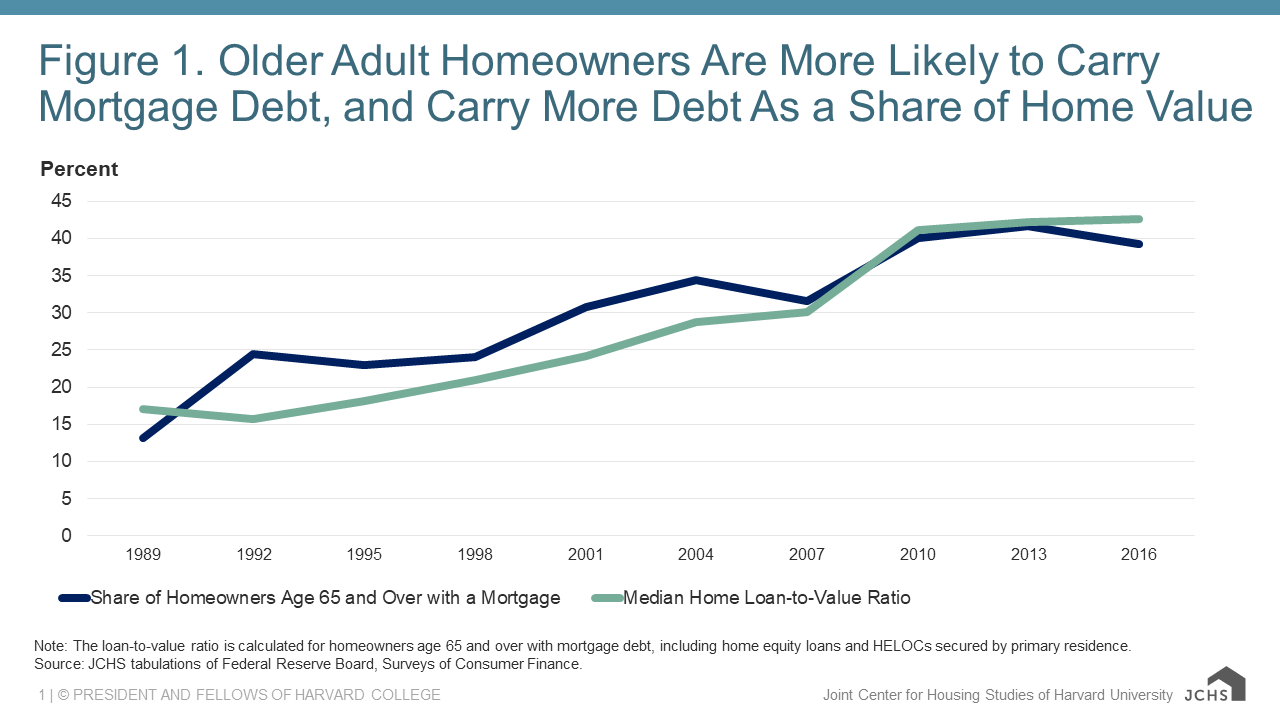

High Levels Of Mortgage Debt Are Associated With Lower Financial Well Being Among Older Homeowners Joint Center For Housing Studies

List Of Top Personal Loan Providers In New Town Best Personal Loans Online Justdial

Foreclosure Help Moshes Law

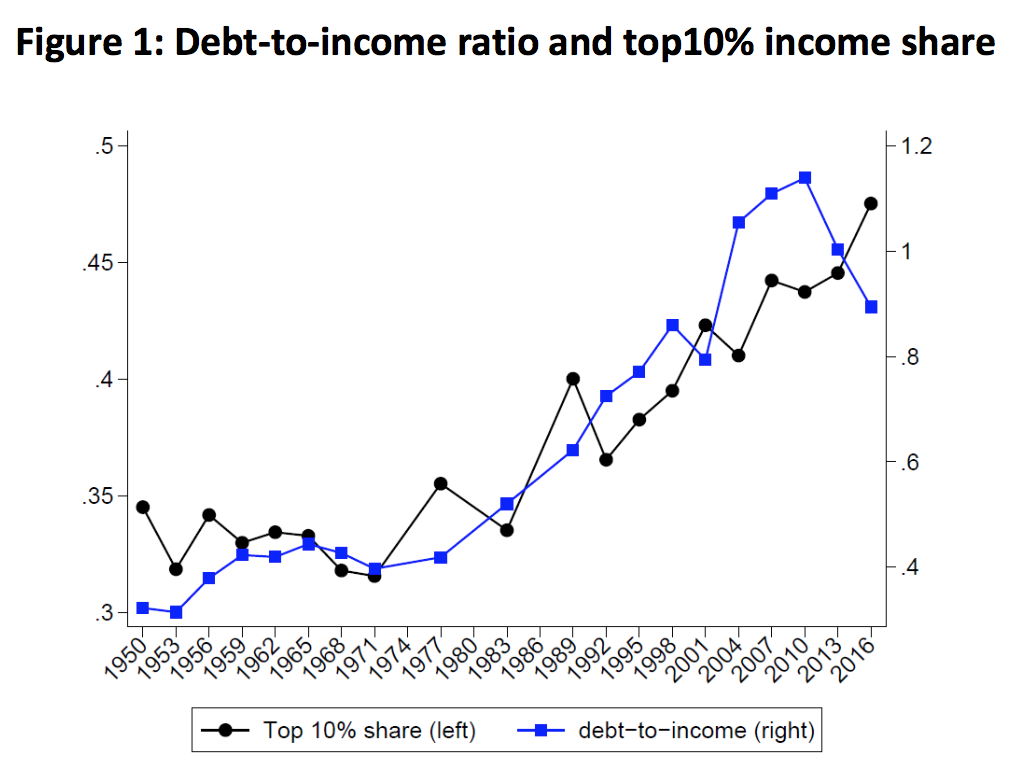

Household Income And Debt

Mortgage Repayments As A Percentage Of Income Download Scientific Diagram

Mortgage Loan Wikipedia

Modigliani Meets Minsky Inequality And U S Household Debt Since 1950 Institute For New Economic Thinking

How Much House Can You Afford The 28 36 Rule Will Help You Decide

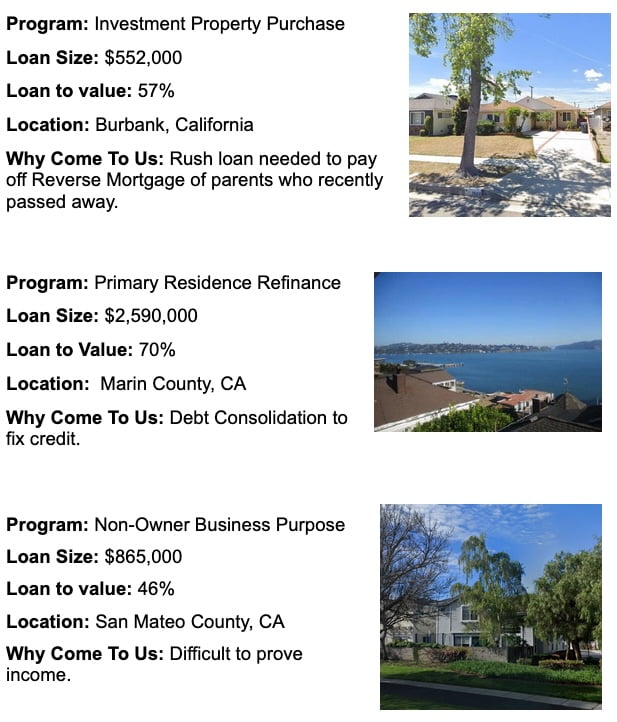

Real Estate Page 16 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Mortgage Income Calculator Nerdwallet

5 Documents You Need To Save Cash At Tax Time Tips For Home Buyers Tax Time Real Estate Tips Tax

Household Debt Composition Mix Student Loans Way Up

Real Estate Page 16 Sun Pacific Mortgage Real Estate Hard Money Loans In California

What Percentage Of Income Should Go To Mortgage Morty

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Stewart Madden Stewartmadden Twitter

How Much House Can You Afford The 28 36 Rule Will Help You Decide